ICP Revolution, Bitcoin & crypto payments are revolutionizing value exchange, Lessons from MicroStrategy's Bold Bitcoin Play, Weekly Crypto News & 0xCamp - Build on ICP & Get Token Launch Ready!

Welcome to Foundership Lighthouse!

Weekly posts and thought leadership from Foundership for founders and investors are curated straight from Foundership's blog, video, podcast, social media, and special updates.

Quick Summary:

The Internet Computer Protocol (ICP) as a revolutionary solution - decentralized alternative to traditional cloud services, enabling tamperproof AI systems and eliminating the need for traditional IT infrastructure.

Growing acceptance of Bitcoin and crypto payments, emphasizing their transformative impact on value exchange.

Insights on strategic debt through MicroStrategy's Bitcoin acquisition strategy and

Zappos is an inspiration

Apply for ICP 0xCamp Token Launch Ready Program

Weekly crypto news updates

The Internet Computer Protocol Revolution

Enterprises spend a staggering $1.8 trillion on IT personnel, $900 billion on software, and $600 billion on cloud services annually.

In this context, the Internet Computer Protocol (ICP) emerges as a one-stop solution to these mounting costs and complexities.

ICP is currently holding the #26 position among all cryptocurrencies with a market capitalization of $3.85 billion. This market performance reflects growing enterprise confidence in ICP's technological framework.

ICP’s fundamental value proposition stems from its unique position as the first "World Computer” blockchain capable of building comprehensive online systems without traditional IT infrastructure.

This has attracted significant institutional interest, backed by prestigious venture capital firms like Andreesen Horowitz and Polychain Capital.

Today's enterprises face significant hurdles with traditional cloud infrastructure:

$179 billion annual cybersecurity spending

$50 billion in cybersecurity incident costs

415% increase in daily transactions from 2022 to 2023

ICP provides a decentralized alternative through its network of independent data centers worldwide, offering tamperproof and unstoppable software systems that eliminate the need for traditional security measures.

With the rise of AI applications, ICP offers a unique proposition for enterprise AI deployment:

Tamperproof AI systems running directly on the blockchain

Zero downtime since its launch in May 2021

Direct integration with existing web services through HTTP requests

The platform's "canister" smart contracts offer advanced capabilities:

Automatic state maintenance without developer intervention

Web-speed performance with transaction finalization in 1-2 seconds

Ability to process both query and update calls for enhanced efficiency

The Internet Computer's architecture enables enterprises to:

Eliminate traditional IT infrastructure costs

Deploy applications without managing servers

Scale globally through 48 data centers worldwide

Major corporations are already recognizing ICP's potential. For instance, Sodexo, the French multinational, has partnered with DFINITY for its digital transformation initiatives.

The platform processes hundreds of millions of computational transactions daily, supporting both enterprise cloud and blockchain-specific use cases.

The Internet Computer integrates security at the protocol level, offering:

Built-in tokenized voting tools for governance

Enterprise-grade custody of digital assets

Verifiable encrypted threshold keys for secure cross-organizational collaboration

As enterprises continue to seek alternatives to traditional cloud services, ICP's combination of decentralization, security, and scalability positions it as a compelling solution for the future of enterprise computing.

Share this with your friends and connections!👇

X post: https://x.com/FoundershipHQ/status/1850916740798038418

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7256685883901313025

Bitcoin and crypto payments are revolutionizing value exchange

Digital payments have transformed dramatically since that fateful day in 2010 when two pizzas were purchased for 10,000 Bitcoin.

Just as the internet transformed information exchange, Bitcoin and crypto payments are revolutionizing value exchange. The question isn't whether to adapt, but how to adapt strategically and responsibly.

The Bitcoin payments ecosystem is not just growing – it's exploding. With projections reaching $1.83 trillion by 2030 and a compound annual growth rate of 20.10%, businesses that hesitate may find themselves playing catch-up.

By accepting Bitcoin payments, you could potentially eliminate the overhead expenses of international transaction fees and currency conversion costs while positioning your brand as forward-thinking and innovative.

Consider a small business owner in Tokyo accepting Bitcoin payments from tourists without worrying about forex rates or credit card fees. This direct payment method exemplifies the borderless nature of cryptocurrency transactions.

Picture a digital nomad traveling through Europe, seamlessly paying for accommodations and meals using a crypto debit card that automatically converts their Bitcoin to local currency. This bridge between crypto and traditional finance is changing travel and commerce.

A tech startup could implement an employee rewards program using Bitcoin-purchased gift cards for popular retailers, creating a modern incentive system that appeals to their workforce.

We're witnessing the normalization of digital assets. Major brands like Microsoft, Starbucks, and PayPal are accepting Bitcoin. A customer can buy their morning coffee with the same cryptocurrency they use to purchase software.

However, the adoption story varies significantly by region:

North America leads with institutional acceptance and regulatory clarity

Europe shows strong adoption in crypto-friendly nations like Germany and Switzerland

Latin America demonstrates how Bitcoin can serve as a hedge against economic instability

Asian markets, particularly Japan and South Korea, showcase integration with retail and gaming

The growing acceptance of Bitcoin payments signals a broader shift in how we think about money and commerce. As regulatory frameworks mature and technology improves, we're likely to see even more innovative applications of cryptocurrency in everyday transactions.

Before jumping into Bitcoin acceptance, consider:

Integration costs and technical requirements

Staff training needs

Risk management procedures

Customer education initiatives

The future of payments is being written now, and businesses that thoughtfully integrate cryptocurrency options today will be better positioned for tomorrow's digital economy.

Share this with your friends and connections!👇

X post: https://x.com/FoundershipHQ/status/1851659569702764586

Linkedin: https://www.linkedin.com/feed/update/urn:li:activity:7257428389727244289

Zappos inspires us all!

Tony built Zappos into a billion-dollar company not by obsessing over profits, but by relentlessly pursuing a vision of exceptional customer service and employee happiness.

His philosophy? Create meaningful connections and lasting impact.

Share this with your friends and connections!👇

X post: https://x.com/FoundershipHQ/status/1851974433608446108

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7257740540874506242

The Art of Strategic Debt - Lessons from MicroStrategy's Bold Bitcoin Play

Conventional wisdom often warns against excessive debt. Yet, some of the most transformative business strategies challenge these notions.

MicroStrategy's ambitious Bitcoin acquisition strategy offers insights into leveraging debt as a tool for potential value creation.

Consider a hypothetical scenario:

You discover an asset you believe will appreciate significantly over time, but your current resources limit your ability to acquire it. Traditional thinking might suggest saving gradually.

However, strategic debt could enable immediate, large-scale acquisition - precisely what MicroStrategy demonstrated with its Bitcoin strategy.

Imagine finding a property in an up-and-coming neighborhood priced at $500,000. You could wait five years to save enough for a down payment, by which time the property might be worth $800,000.

Alternatively, securing a low-interest loan today could let you capture that $300,000 appreciation, minus interest costs.

The Three Pillars of Strategic Debt

Low-Cost Capital: MicroStrategy's success partly stems from securing favorable interest rates, some as low as 0.75%.

Asset Appreciation Potential: The strategy banks on the acquired asset's growth outpacing debt costs.

Risk Management: Maintaining core business operations while pursuing aggressive growth opportunities.

MicroStrategy's approach demonstrates how innovative financial engineering can create value. While they chose Bitcoin, the principles apply broadly.

A software company might use debt to fund R&D, betting that innovation returns will exceed borrowing costs.

As traditional asset classes become increasingly correlated, companies may need to explore unconventional strategies for value creation.

The key lies not in blindly copying MicroStrategy's Bitcoin strategy, but in understanding the underlying principles of strategic debt deployment.

Remember the dot-com bubble - Not every bold strategy succeeds. Strategic debt requires careful consideration of market conditions, risk tolerance, and long-term sustainability.

Share this with your friends and connections!👇

X post: https://x.com/FoundershipHQ/status/1853344126022086944

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7259110762894254081

Weekly Crypto News

Kraken's Leadership Restructuring

Arjun Sethi appointed as new co-CEO alongside David Ripley

Sethi is a Tribe Capital co-founder and has been on Kraken's board since 2021

Company announced plans to become "leaner and faster" with organizational changes

Reports suggest 15% of staff may have been laid off

FTX Executive Sentencing

Nishad Singh, former FTX engineering director, sentenced to time served

Received three years of supervised release for misappropriating funds

Singh expressed "overwhelming remorse" for his role in the FTX scandal

Was the fourth FTX executive to face sentencing after Bankman-Fried, Ellison, and Salame

Trump Election Impact on Crypto

Analysts predict potential crypto market rally if Trump wins presidency

Swyftx analyst warns of increased market volatility around election day

Derive options data shows traders preparing for significant price movements

Experts advise caution despite possible "dopamine hit" from Trump victory

Build on ICP to receive Grants of $50,000 from Dfinity Foundation and Get Token Launch Ready!

3-month Olympus Acceleration program by Foundership, where startups Build on ICP to receive Grants of $50,000 from Dfinity Foundation and Get Token Launch Ready!

👉 https://foundershiphq.com/icp-0xcamp

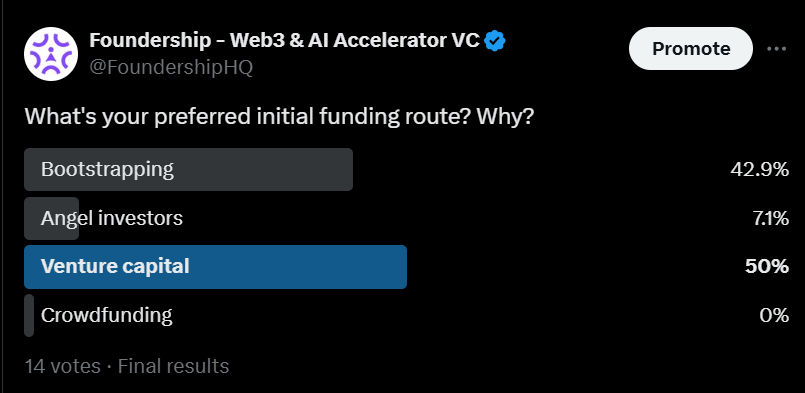

Hello Founders, what's your preferred initial funding route?

Share this with your friends and connections!👇

X post: https://x.com/FoundershipHQ/status/1851236285156901023

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7257002376941764608